Uncategorized

HOW THEMBA MLISWA PLAYED A PART IN EXPOSING MNANGAGWA

Published

1 year agoon

By

Peter SmithA member of the Justice Under Rule of Law (JUROL) reminded me that Mliswa by default provoked the creation of a the Friends of Shabanie and Mashava Mines Trust (FOSMM) becauae his understanding that was never tested was that the acquisition of SMM was a political project authored by Mnangagwa and financed by the government of Zimbabwe.

This view is inherent and self-evident in the words of Mliswa eloquently expressed on this link.

https://threadreaderapp.com/thread/1078529544036978688.html

It has been established that the first time, Mliswa met Mawere was in Luton, UK, when Mawere was on a visit to the UK and agreescto meet with students and Zimbabweans in the diaspora.

However, what is clear is that Mliswa like many Zimbabweans exoosed his ignorance about the SMM acquisition.

perhaps unknown to Mliswa, is the narrative that informed the then Joint Ministers in the GNU of Home Affairs to revoke the specification order that Chinamasa issued in.relation to Mawere on July 9, 2004 on fabricated reasons aa part of a corrupt scheme to divest and deprive Mawere using public power of his companies.

Set out below is a copy of the said report:

Report on the SMM matter

History and Background

Acquisition

Mr. Mawere is the Chairman and sole shareholder of Africa Resources Limited (ARL). Mr. Mawere was born in Zimbabwe and left Zimbabwe in 1988 to work for the World Bank.

In 1995, he relocated to South Africa.

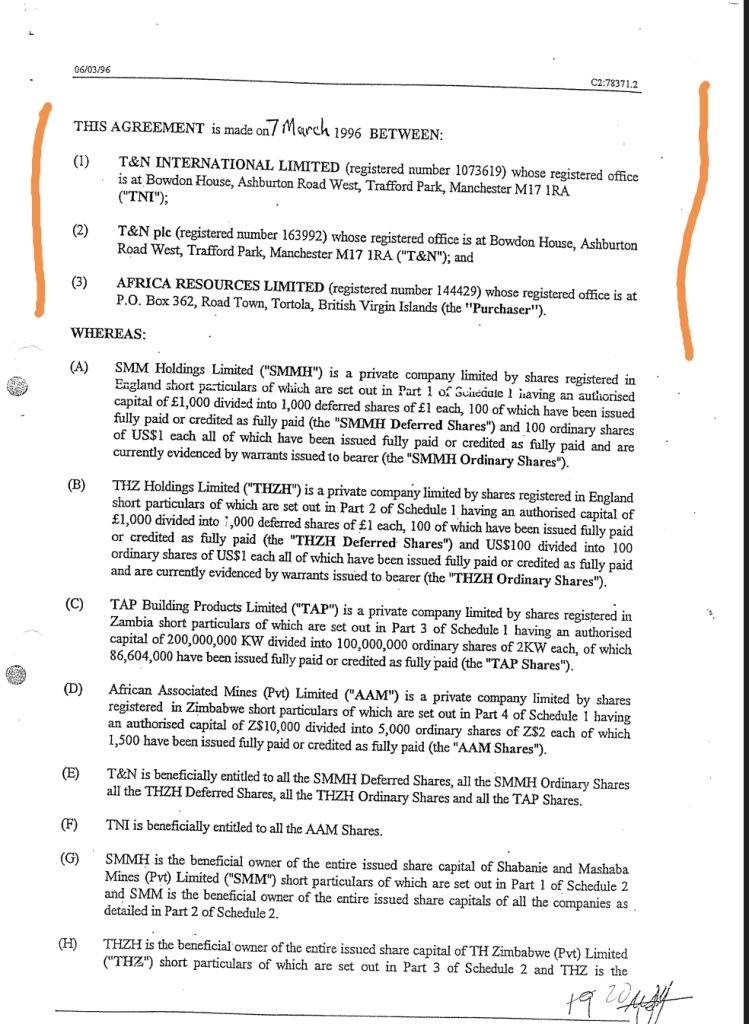

On 6 September 1995, Mr. Mawere made an unsolicited offer to acquire the entire shareholding of T & N Plc in Shabanie & Mashaba Mines Private Limited. T & Ns interests in Zimbabwe comprised of the two asbestos mines, Turnall Fibre Cement and Tube & Pipe Industries Private Limited.

On 7 March 1996, ARL concluded an agreement with T & N Limited (formerly T & N Plc)(In Administration)(T & N) for the purchase of the SMMH and THZH shares for US$60 million.

SMMH is and has always been the sole shareholder of SMM.

The purchase price was to be paid in monthly instalments of US$5 million from SMMs export proceeds under a payment mechanism approved by the RBZ.

On 15 March 1996, ARL also concluded a memorandum of deposit and charge with T & N in order to secure its payment obligations. As a consequence, T & N became a creditor of ARL and in turn ARL pledged the shares held in SMMH and THZH as security.

At the time Mr. Mawere was specified on 9 July 2004, US$37 million of the purchase price had been paid leaving a balance of US$23 million plus accrued interests. In addition, US$6 million was paid in respect of interest on the principal amount.

The acquisition was a commercial deal involving T & N as vendor and ARL as purchaser.

No government guarantee was used in support of the acquisition.

2.2 Externalisation Allegations

In December 2003, the RBZ introduced regulations regarding the surrender of foreign exchange proceeds by exporters. In addition, a facility was put in place whereby companies could borrow for working capital purposes in Zimbabwe dollars from their banks at concessionary interest rates and repay from export proceeds. This facility was called the Productive Sector Facility (PSF).

Prior to the introduction of the new surrender requirements, SMM had the authority to surrender 25% of its export proceeds with the balance used to finance the import requirements of the SMM Group.

The change in the surrender requirements had a detrimental impact on the ability of SMM to pay to its foreign creditors. As a consequence, discussions took place between the RBZ and the company between January and April 2004 to no avail.

On 1 April 2004, the marketing exemption granted to SMM by MMCZ to market its own asbestos was terminated. This meant that MMCZ was now in charge of the marketing of the asbestos produced by SMM.

Between December 19, 2003 and May 2004, SMM received about US$12 million in export proceeds. Under the new surrender rules, the export proceeds were converted into local currency at official exchange rate leaving SMM with no access to foreign currency to pay to its foreign creditors and more significantly with limited local currency to support its operations.

Under pressure from foreign creditors, Petter Trading Pty Limited (Petter) was forced to apply to a South African court for an order allowing it to collect what was due from SMM from SAS, an agent of SMM. The effect of the order was to give comfort to the creditors of Petter who were not being paid.

An order was granted with SMM and SAS consent to cede SMMs claims against Petter. At the time, Petter was owed about ZAR74 million by the SMM Group in respect of the equipment supplied to Schweppes and for goods supplied to the mines.

Following the granting of the cession court order on 6 May 2004, allegations were made that the author of the cession court document was Mr. Mawere.

It was argued that the effect of the cession court order was to divert funds due to SMM from SAS and, therefore, this was deemed to constitute a violation of the exchange control regulations of Zimbabwe.

The basis of the externalisation allegations were that as at 31 March 2004, SMM was owed the following amounts by SAS US$18,464,595.27 million, CAD$628,071.84 and ZAR4,515,367.48.

SAS is a company registered in South Africa. It is a wholly owned subsidiary of AR Projects Services Pty Limited (ARPS) that in turn is wholly owned by SMM Holdings Pty Limited (SMMSA). SMMSA is wholly owned by Mr. Mawere.

Notwithstanding the legal ownership structure, it was deemed in Zimbabwe that Mr. Mawere as the ultimate shareholder of both SMM and SMMSA was culpable in terms of Zimbabwean laws for the alleged diversion of funds from SMM to Petter.

To the extent that funds were alleged to have been diverted from SAS through the court order, it was deemed that Zimbabwean interests were prejudiced by the court order.

2.3 Warrant of Arrest

On 22 May 2004, a warrant of arrest was granted in Zimbabwe against Mr. Mawere on allegations that through the cession court order, funds due to Zimbabwe were diverted to Petter.

An extradition application was then made in South Africa leading to Mr. Maweres arrest on 25 May 2004. He was granted bail on 27 May 2004.

The extradition application was heard on 29 June 2004. The application was dismissed.

2.4 Specification of Mr. Mawere

Following the dismissal of the extradition application, Mr. Mawere was specified in terms of the Prevention of Corruption Act on 9 July 2004 by Hon. P. Chinamasa who at the time was responsible for administering the Act.

Pursuant to the operation of the specification order, Assistant Commissioner S. Mangoma was appointed as Investigator of Mr. Mawere.

2.5 Specification of SMM

On 26 August 2004, SMM and related companies deemed to be under the control of Mr. Mawere were specified.

Mr. R. Saruchera was appointed Investigator.

2.6 Reconstruction of SMM

On 3 September 2004, a Statutory Instrument was gazetted. On 6 September 2004, Hon. Chinamasa appointed Mr. Gwaradzimba as Administrator of SMM with Forbes Mugumbati and Robert Kasi as Assistant Administrators.

The effect of the Reconstruction Order, in terms of Section 4(3) of SI 187 of 2004 was to place all companies associated to SMM as section 3(1) of SI 187 of 2004 under the control of the Administrator.

2.7 Administration of the Prevention of Corruption Act and Reconstruction Legislation

Both Saruchera and Gwaradzimba were appointed by Hon. Chinamasa. He was in charge of administering both Acts. Mangoma was also appointed by Hon. Chinamasa.

What is significant is that Saruchera only completed his report on 30 November 2004 meaning that at the time of Gwaradzimbas appointment, Hon. Chinamasa did not have the benefit of Sarucheras findings and recommendations.

At no stage did Saruchera contact Mr. Mawere during his investigations. More significantly, no investigations were done by Mangoma until the administration of the Prevention of Corruption Act was reassigned to the Ministry of Home Affairs.

When the responsibility of administering the Prevention of Corruption Act was reassigned, there were a number of individuals who were specified. Such individuals included: Messrs. William Nyemba, Mthuli Ncube, Julius Makoni, James Mushore, James Makamba, Gilbert Muponda, Mutumwa Mawere, Zimuto, Moxon among others.

A decision was taken to review all these outstanding cases. On review, it was established that there was no valid factual and legal basis for specifying a number of the individuals.

Following investigations, a number of the specified persons were de-specified including Mawere.

However, with respect to Mawere, who was de-specified on 19 may 2010, it was established that his affairs were dealt with in terms of two laws i.e. Prevention of Corruption Act and the Reconstruction of State Indebted Insolvent Companies Act.

It has emerged that the Administrator and the Investigators were working in silos. Whereas the Prevention of Corruption Act set out what should happen in respect of the assets of a specified person, the Reconstruction Laws created an Administrator who had powers over the very assets that were suppose d to be protected in terms of Section 10(2) of the Prevention of Corruption Act.

The issue that immediately confronted the Ministers of Home Affairs in respect of the SMM matter was regarding the protection of Maweres assets and to who was accountable for their security.

At issue is whether the affairs of a specified person can be dealt with in terms of another law before an investigation is completed.

Following his de-specification, Mr. Mawere approached the Co-Ministers of Home Affairs to return his assets.

Pursuant to this request, it was then established that all the assets were placed under the control of the Administrator without the permission of the Investigators and more importantly assets have been disposed of without the knowledge and permission of the Investigators.

Both Saruchera and Mangoma were not informed by Gwaradzimba of any asset disposal. Mr. Gwaradzimba reports to Hon. Chinamasa.

The Investigators sought to procure the inventory of assets belonging to the former specified persons only to find out that the assets had been dealt with in terms of the Reconstruction Laws. The issues that then arose are as follows:

3.1Alleged default by ARL in respect of the acquisition price

A review of the reports prepared by the Administrator showed that following the placement of SMM under reconstruction, a decision was made to take control of SMMs UK registered parent company on the premise that ARL had defaulted in its alleged payment obligations to T & N. It is common cause that the debt to T & N was not fully paid with US$23 million outstanding as at 6 September 2004.

Gwaradzimba sought the approval of the Inter-Ministerial Committee on SMM to approach and purchase the entire shareholding in SMMH using a nominee company, AMG Global Nominees Private Limited (AMG).

Our investigations have revealed that Gwaradzimbas initials are AMG standing for Afaras Mtausi Gwaradzimba. AMGs shares are owned by Gwaradzimba.

The company was then used to acquire the bearer share warrants held by AMG. The acquisition was made in November 2004. The purchase price of US$2 million was paid by the RBZ on behalf of AMG.

Following the acquisition of the bearer share warrants, AMG then approached the UK Court for an order to rectify the shareholding register of SMMH and THZH.

The application was opposed by both SMMH and THZH. ARL, the parent company of SMMH and THZH, intervened in the proceedings as a Part 20 Claimant against AMGs contention that it was entitled to be registered as a shareholder of THZH and SMMH.

The application by AMG was dismissed. AMG appealed and lost the appeal with costs.

Notwithstanding, our Investigators who met with Gwaradzimba two weeks ago were informed that AMG was the holder of the bearer share warrants and, indeed, it was the legitimate shareholder of SMM.

Gwaradzimba was then requested to produce the bearer share warrants. He failed to do so on the basis that the warrants were stored in the companys safe and he did not have t he keys. He also informed the investigating team that he could only release the warrants with the approval of Hon. Chinamasa.

Although it has been established that if AMG has possession of the warrants this would constitute contempt of the UK court order.

In the circumstances, there is no option but to compel Gwaradzimba to provide the originals of the warrants.

The ownership of SMMH and THZH is critical in determining whether the reconstruction scheme has been implemented strictly in terms of the Law.

Under the law, the consent of shareholders and creditors is mandatory before a scheme is confirmed by a Judge.

However, when the control and management of SMM was placed under Gwaradzimba, there was no provision in the statutory instrument for the involvement of the Courts.

Ownership of SMMH and THZH

Hon. Chinamasa based on the advice of Gwaradzimba and Manikai has represented that SMMH is now 24% owned by AMG Global Nominees (Private) Limited (AMG) on account of the bearer share warrants purportedly purchased by AMG in November 2004 from T & N.

Both Gwaradzimba and Manikai were intimately involved in the UK litigation. They are aware that AMG did not obtain any or any good title to the bearer share warrants. In fact, the lawyers representing AMG did confirm that the warrants were held to the order of T & N and not AMG.

The UK Court ruled that ARL did not default on its payment obligations and, therefore, T & N had no right to sell the warrants to AMG. Effectively, the situation pertaining to the shareholding of SMMH and THZH remains as was in 1996 when ARL acquired the two UK companies.

The statement issued by Minister Chinamasa on 24 October caused us to probe further the question of the true ownership of SMM. An extract of the statement dealing with the ownership of AMG is as set below.

It is important to understand the concept of share warrants.

A share warrant is a document in which it is stated that the bearer of the warrant is entitled to the shares specified therein.

In the case of SMMH, ordinary shares are held and have always been held since 1996 by Africa Construction Limited (ACL) and the deferred shares as follows: T & N Welfare Trust Limited (1 share) and T & N Holdings Limited (99 shares).

A share warrant is a bearer “document of title” to the shares, issued by the company under its common seal, duly stamped and signed by one or more directors of the company, as per Articles’.

A share warrant is just like a negotiable instrument. The shares specified therein may be transferred by delivery of the warrant only, and any bona fide holder for value will obtain a perfect title to the shares. In other words, a share warrant represents a bearer share and a bearer share is just like a bearer cheque.

When SMM was placed under the control of Mr. Gwaradzimba on 6 September 2004, the shareholder of SMMZ was SMMH hence the only party that the Administrator had to interact with pursuant to the operation of the Reconstruction Laws was SMMH.

So when Gwaradzimba stated on page 13 of his letter to Hon. Chinamasa dated 9 November 2010 that: As of today, AMG Global Nominees are holders, on behalf of GOZ, of the SMM UK and THZ UK bearer share warrants and, therefore, are the owners of those companies and their subsidiaries, including SMM he must have known this not to be true.

We then conducted a company search in the UK to determine the true position with respect to the statutory records of SMMH as reflected in the UK Companies House.

Set out below is an extract of the record extracted from the Companies House.

The court ruled that ARL had not defaulted and, therefore, T & N had nothing to sell to AMG. Accordingly, the Judge made the following ruling:

Accordingly, it is declared that:

a. ARL alone has title to the bearer share warrants relating to SMM Holdings Limited and THZ Holdings Limited subject to T&Ns continuing security under the terms of the MDC for payment of the balance of the purchase price for the bearer share warrants and accrued interest;

b. AMG did not, pursuant to the Share Sale Agreement dated 5 November 2004, obtain any or any good title to the bearer share warrants; and

c. The said warrants are to continue to be held by Reed Smith Richards Butler subject to further order and subject to their undertaking to retain them in their possession and not to deliver to AMG or to its order.

Gwaradzimba, however, acknowledges that he never sought and obtained the consent of the shareholder of SMMH but makes the point that the Cabinet Committee on SMM was apprised of this and they made the decision to proceed with the confirmation and approval of the reconstruction scheme.

Notwithstanding, the minutes that he signed on 24 June 2005 stated that the decision to approve the reconstruction scheme was unanimous. The attendance register that was attached to the application by Hon. Chinamasa to confirm the reconstruction order in chambers shows that there was no creditor represented and no representative of SMMH was also represented.

Although Gwaradzimba made the point that:On realizing that there were no shareholder representatives at the meeting referred to in (i) above, the Administrator reported this to the Cabinet Committee. It is critical to note that this was not necessary as the members had been publicly invited to the meeting of creditors and members, but had chosen not to attend the same [see 5.3.1 (1) a) above]. The Administrators report to the Cabinet Committee about the non-attendance of the members was out of his benevolence and professional aptitude that called for prudence, caution and the need to leave-no-stones-unturned. After the Administrators report to the Cabinet Committee on the members failure to attend the meeting of creditors and members, the Administrator proposed as follows:

(a) that the Administrator be allowed to go on a discovery mission, and meet with representatives of T&N Plc in London, in order to find out more about the ownership of SMM Holdings Limited (SMM UK) and THZ Holdings Limited (THZ UK); and

(b) that, if agreed, and seen plausible, based on the outcome of discussions with T&N Plc, the Proposed Scheme of Reconstruction be presented to T&N Plc as a significant stakeholder (member) in the SMM fortunes (or, is it, misfortunes) he was well aware as early as October 2004 that T & N had represented that it was not a shareholder of SMM. Gwaradzimba knew that the sole shareholder of SMM was SMMH.

The question that then arises is whether a Cabinet Committee had the authority to override the power of shareholders to approve the reconstruction scheme.

The rights conferred on shareholders in terms of the reconstruction laws were meant to overcome the constitutional problems presented by the laws.

In the SMM case, what is now being suggested is that notwithstanding the lack of approval by shareholders of the reconstruction scheme, the confirmation order granted by Justice Kamocha in December 2005 should still be valid.

SMMs approach to the Government of Zimbabwe (GOZ) for funding

It has been suggested that the government was justified to intervene in the manner it did in SMM because it was SMM that approached the government for financial support.

We have examined the records of the company and find no evidence confirming that there was direct government financial assistance to SMM.

Recognizing that the control and management of a company registered in terms of the Companies Act vests with the board of directors to whom management is accountable, what has been placed before the investigation team is the fact that SMM management and not the board approached government after Mawere and SMM were specified for financial assistance.

It has been suggested that the GOZ had provided SMM with direct funding in the form of two tranches of Z$20 billion and Z$10 billion, respectively.

The said funds were actually injected by Zimbank under the PSF arrangement. Under the PSF window, a total of Z$3 trillion was provided to various enterprises.

A letter dated 3 November 2004 from the RBZ to Zimbank has been used in support of the contention that the funds advanced by Zimbank were indeed government funds and Zimbanks role was purely that of facilitation.

It is clear from the letter that it was authored by the RBZ and no copy was made to any government department to confirm the direct role of the government in the transaction.

This said letter came 59 days after the placement of SMM under reconstruction.

It, therefore, means that when SMM was placed under reconstruction, the loan was in the books of Zimbank and not the government as alleged.

Accordingly, there was no legal relationship between the GOZ and SMM in respect of the funds provided by Zimbabnk otherwise this letter would have been unnecessary.

The contents of the letter are more revealing.

Reference is made to a letter from Mr. Mushayakarara, the Group CEO of Zimbank, to the Governor of the RBZ dated 20 September 2004 or 15 days after SMM was placed under reconstruction regarding the disbursement of Z$30 billion through Zimbank.

Why would Mr. Mushayakarara write to the RBZ instead of the purported responsible government department involved in the transaction?

The only reason would be that at the time, the control and management of SMM was already under the control of Gwaradzimba and any bank would have wanted clarity from the RBZ on how best to handle the situation that did not exist at the time the loan was granted and funds disbursed.

The first tranche of Z$20 billion was disbursed on 24 May 2004. The facts of the matter are that when the loan was disbursed, an extradition application was already made i.e. 22 May 2004 against the ultimate beneficial shareholder of SMM, Mr. Mawere.

SMM was under the control of a board of directors and for any funds to be disbursed there would have been an agreement between Zimbank and SMM.

The second tranche was disbursed on 17 August 2004. By this day, Mr. Mawere had already been specified and, therefore, the control structure of SMM was already altered and under the government. Mr. Mawere was specified on 9 July 2004.

It is instructive that the letter was signed by Ms. Mushipe who was the responsible person for the PSF window under the RBZ. This confirms that the funds disbursed could only have been processed under the PSF arrangement and none other.

Notwithstanding, Ms. Mushipe exposing the attempt to retrospectively change the nature of the transaction stated that: We confirm that Zimbanks role in these disbursements was that of facilitation only and that the exposure should not be recorded as a liability in Zimbanks books.

Why would a confirmation have been required if it was common cause that the funds came directly from the GOZ? Why would the RBZ write such a letter if there was a direct relationship between SMM and the GOZ?

If funds came from the GOZ, then why would Mushayakarara write to the RBZ? Between 24 May and 17 August, 2004; respectively, it means there was no knowledge about how the funds disbursed to SMM were recorded in the books of Zimbank. No bank would disburse funds to a client without knowing the true nature of the relationship between the parties.

Why would Gwaradzimba want to distort the legal and factual matrix of the Z$30 billion PSF facility?

Without manufacturing a direct link between the GOZ and SMM, the justification for placing SMM under reconstruction would have become problematic.

It is then alleged by Gwaradzimba that SMMs second approach to GOZ for funding resulted in GOZ appointing an investigator to look into the affairs of SMM.

The facts are that the Investigator was appointed to look at the allegations of externalisation which arose in May 2004 prior to the first disbursement. The appointment of an investigator had, therefore, no connection with the request for funding.

On 26 August 2004, Mr. Saruchera was appointed Investigator for SMM and related companies.

When Gwaradzimba states as fact and true that “when the Investigator completed his work and presented his report to GOZ, it became evident that SMM was indebted to almost every bank in town and this led GOZ to issue a reconstruction order”, he is not telling the truth.

Mr. Saruchera completed his report on 30 November 2004 well after SMM was placed under reconstruction.

How then could Hon. Chinamasa have relied on a report that did not exist at the time the reconstruction order was issued?

When Gwaradzimba was appointed on 6 September 2004, Mr. Saruchera had not even started his work. Between 6 September and 30 November 2004, Mr. Saruchera appointed in terms of the Prevention of Corruption Act and Mr. Gwaradzimba in terms of the Reconstruction Regulations co-existed and there is no evidence that Gwaradzima sought any permission from the Investigator to deal with the assets of SMM.

By the time Saruchera had finished his report; Gwaradzimba had already confirmed the indebtedness of SMM to the GOZ and made a finding on externalisation.

At no stage did the Minister rely on Mr. Sarucheras report to make a decision to place SMM under reconstruction.

With respect to the PSF facilities, it is significant that Hon. Murerwa, former Minister of Finance, dealt with the structure, legal and commercial relationships between the RBZ, authorised dealers (banks) and the borrowers.

The question of the role of the RBZ in the context of the PSF facilities was clarified by Hon. Murerwa in response to a question posed in Parliament on 6 July 2005. He stated as follows:

“The Reserve Bank of Zimbabwe (RBZ) does not perform functions of commercial banks. The mandate of the RBZ is derived from the Reserve Bank of Zimbabwe Act [Chapter 22: 15], whereas the operations of banking institutions are governed by the Banking Act [Chapter 24: 201.

Both Acts mentioned above authorise the RBZ to supervise and regulate banking institutions. The RBZ is clearly the regulator of banking institutions and does not perform the functions of commercial banks.

If the Hon. Member were referring to the various facilities being funded by the RBZ, I would advise that the Reserve Bank of Zimbabwe Act allows the RBZ to allocate funds and to make investments in pursuance of national economic goals. By availing the various facilities, the RBZ is merely exercising its mandate.

As the Hon. Member is well aware, the RBZ does not deal with the public in the same way as commercial banks.”

If Z$3 trillion was disbursed under the PSF arrangement, the question that arose is why SMM would be treated any differently from the other borrowers.

Although Hon. Murerwa correctly spelt out the fact that the necessary legal relationships are sufficiently secured through contracts and banks would be able to recover funds from clients, in the case of SMM this was not the case.

The relationship between SMM and Zimbank was secure and complete until reconstruction when the RBZ sought to retrospectively amend the clear legal nexus between the contracting parties.

In the letter referred to above, it was Zimbank that contacted the RBZ without the knowledge of the client, SMM, regarding repayment.

Why would Zimbank approach the RBZ without SMMs involvement? Why would the RBZ respond to Zimbank on a matter involving SMM without the courtesy of informing the companys board about the arbitrary assumption of claims by the GOZ?

Although in the letter from Ms. Mushipe, it was stated that the role of Zimbank was that of a facilitator there is no mention as to whom the bank was facilitating.

The obvious conclusion is that it was facilitating the RBZ and not the GOZ.

This would be the natural conclusion as the government has no mechanism on providing credit to the private sector without going through the budgetary process and informing parliament. In the case of SMM, there is no evidence that any funds were sourced from Treasury for the purpose of helping SMM and what agreements, if any, existed between the GOZ and Zimbank in respect of SMM.

No explanation was provided by Gwaradzimba regarding why SMM would be the only company forced to source funds from the GOZ when other companies were allowed to utilize the PFS facilities.

What seems obvious is that there was a conspiracy between the RBZ and some government officials to create the jurisdictional circumstances to justify the intervention by the government.

However, no facts support the allegation that the government provided Z$30 billion directly to SMM.

Externalisation of SMM export proceeds

It has been suggested that allegations of externalisation against Mawere have been proved in Court. A number of court applications were made by SMM in South Africa.

At the root of the problem was the allegation that the effect of the cession court order was to divert funds due to SMM from SAS to other parties including Petter.

The first court application instituted by SMM at the instigation of Gwaradzimba was an application to rescind the cession court order obtained by Petter. This was successfully done by SMM.

All this action proved is that the cession court order had not received the consent of all the parties to it. This did not advance the allegation of externalisation any further.

SMM applied for the liquidation of SAS. The application that was defended was granted largely because with the termination of the marketing relationship between SAS and SMM, SAS could not continue in business.

SMM then filed a claim against the estate of SAS. The claim was subjected to an interrogation by the Master of the High Court in South Africa. On the day of the interrogation, SMM withdrew the claim from interrogation opting to establish its claim through a court action.

As part of our investigation, we had to deal with the prejudicial aspect of the cession court order. Our investigations revealed that there was no prejudice to Zimbabwe.

The investigators sought to establish from SMM and Gwaradzimba the basis of the claim against Mawere and SAS.

What was established is as follows:

SMM is a Zimbabwean registered company and SAS is a South African registered entity.

SAS was liquidated in June 2005.

SAS affairs are under the control of Joint Liquidators appointed in terms of South African laws.

Gwaradzimba was appointed in terms of Zimbabwean law. Zimbabwean laws have no extra-territorial application.

Externalisation as defined in Zimbabwe would relate to the non-remittance by an importer in this case SAS.

What has been alleged is that the failure by SAS to remit funds to SMM was caused by Mawere. How true is this?

It is important to understand the allegations and the factual and legal issues involved. In support of the allegation against Mawere, the following facts are presented to the Minister by Gwaradzimba.

Summary of amounts allegedly owed by SAS to SMM, as at 6 September 2004 were presented in the claim that was presented to the Master and later to the Court.

It was then argued that by virtue of the cession court order, all the amounts allegedly owed by SAS to SMM as at 31 March 2004 represented the entire amount externalised by Mawere.

No attempt was made to establish from the records of SAS whether in fact Mawere had diverted any funds from SAS as alleged.

If this was the case, the crime would have occurred in the jurisdiction of South Africa and not Zimbabwe.

Putting aside the jurisdictional issues, it was important for the investigation team to independently establish whether SAS had funds available around the time of the cession court order that could be diverted.

The team met with the Master of the High Court and established that no such funds were at the disposal of SAS.

What was confirmed is that SMM did owe a number of South African companies about US$13 million at the time it was placed under reconstruction.

SMM has yet to pay these amounts. Some of the principal creditors to SMM like Petter, Coma Transport and Shipping Consolidated Holdings have not been paid a single penny since the placement of SMM under reconstruction.

The liquidators of these companies have failed to obtain the cooperation of Gwaradzimba in recovering their funds.

Instead what Gwaradzimba has sought is to make the companies culpable and liable to SMM based on an enquiry that was conducted by Gwaradzimbas partner. The South African companies identified as culpable were not invited to the hearings.

The basis of the SMM claim is as follows:

Based on the above, it is SMMs case that SAS owed the amounts set out above. No distinction is made between Mawere and SAS in the construction of the externalisation allegations.

However, Mawere and SAS are separate entities and yet Gwaradzimba makes no distinction between the two.

SAS and SMM had a trading relationship. It is important to unpack the nature of the relationship between SMM and SAS.

This is disclosed in a claim that was submitted by SMM against the estate of SAS.

Set out below are extracts from the claim document.

As stated above, the claim was for ASBESTOS FIBRE SOLD TO VARIOUS CUSTOMERS THROUGH THE SAID COMPANY AS THE AGENT OF THE SAID CREDITOR. This is the basis of the externalisation allegations against Mawere.

It is clear that the relationship between SMM and SAS was that of principal and agent. Accordingly, the claim was, therefore, not for exports by SMM to SAS rather for exports by SMM to various customers. Accordingly, it was necessary for the state to provide evidence that the said amounts were supported by evidence that SAS had received funds from SMMs customers.

The schedule shown above does not establish the case of externalisation against Mawere. SMMs cause of action can only be against SAS and not its purported shareholders.

The affidavit is signed by Mr. Washington Samanga.

Notwithstanding, Mr. Samanga then signed a supporting affidavit whose contents contradicts the assertion that SAS was an agent of SMM.

His affidavit is as set out below:

However, on paragraph 4.4 he state as follows:

And on paragraph 4.4, he states as follows:

The above statements are contradictory. It would appear that on paragraph 3 above, the claim was based on asbestos sold by SMM through SAS as agent and yet in paragraph 4.4 the same claim is based on asbestos fibre sold and delivered to SAS and in respect of which SAS had received payments.

At the very minimum, the onus is on SMM to provide evidence that SAS did receive money from its various customers.

No proof is furnished and instead a reconciliation showing flow of funds between SAS and SMM during a period of over 4 years is submitted.

The investigation team sought to establish from SMM as to what precisely was the relationship with SAS. The basis of the claim is on the premise that SAS was an agent of SMM and yet no evidence has been provided confirming that firstly SMM had exported the said goods and funds had been remitted by SMMs customers to SAS.

The first task for the investigation team was to establish from the RBZ the total amount that SMM was due to receive from its exports at the material time.

What the investigation team established was that SMMs un-acquitted CD1 forms had a value of about US$1 million including amounts accrued during Gwaradzimbas tenure.

This number is at variance with the figures used by Gwaradzimba to confirm culpability and justify allegations of externalisation.

SMM could not provide a record of the supporting export documents.

To sustain an allegation of externalisation, an input from the RBZ was necessary. The RBZ confirmed that no externalisation had taken place.

Accordingly, without a complainant, it was difficult to proceed with the criminal matter.

The second anomaly relates to the period that the claim relates to. The normal period within which CD1 forms should be acquitted is 90 days. However, the SMM claim relates to a period of over 4 years.

Now turning to the claim form submitted in South Africa by SMM on the back of information obtained from Samanga.

He states as follows in paragraph 4.5:

A claim should be self standing and not based on admission by a debtor. A claim ought to be proved before a presiding officer in terms of South African laws and should be examined by the liquidator.

In this case, SMM under the control of Gwaradzimba proceeded to appropriate assets of SAS. Gwaradzimba has no jurisdiction over the affairs of SAS and yet he chose to set off an amount of US$4.65 million without the involvement of the courts.

The investigations conducted revealed that Mawere could, therefore, not be capable of externalising any funds. He had no direct relationship with SMM. He was not a director of SMM. He last served on the SMM board in 1997.

If the allegation is that SAS failed to remit funds then the claim ought to be against SAS in terms of South African laws.

The liquidators of SAS would be vested with the power to recover the assets for the benefit of the estate.

An Administrator appointed in terms of Zimbabwean laws would have no jurisdiction to deal with the assets of SAS.

Notwithstanding, Gwaradzimba is of the view that he could recover assets of SAS by repossessing the CFI shares through the High Court of Zimbabwe.

No court order has been granted authorising Gwaradzimba to reduce the amount of claim to SAS by a set-off.

If Mawere had committed fraud, this would be a crime in South Africa and not Zimbabwe.

It is the allegation of Gwaradzimba the Cession Agreement was fraudulent. One of the key elements of fraud is prejudice. Who would have been prejudiced?

It would be SAS and not SMM if the allegation is that the effect of the cession court order was to divert funds from SAS to other parties.

The said funds would belong to SAS. SMM would have a claim against SAS and SAS in turn would recover assets from the parties that so benefited unjustly from the alleged diversion of funds. Who then is best empowered to confirm fraud?

It would only be the Liquidators of SAS.

Why is it then that the liquidators of SAS who are in possession of the books of SAS have not alleged fraud?

Instead the liquidators of SAS have examined the SMM claim against SAS and concluded that it should be expunged. The claim is misleading.

If SAS was an agent, then SMM should first prove that SAS was paid by its customers. The table presented by Gwaradzimba does not prove that SAS was paid.

What was puzzling to the Investigators is that notwithstanding the allegation of externalisation for the total amount allegedly due to SMM from SAS, there is evidence of Gwaradzimba instructing debtors of SAS not to pay directly to SAS but to SMM.

The investigators have confirmed that SMM at the instigation of Gwaradzimba did collect funds due to SAS directly from SAS debtors.

In addition, there is correspondence from Chandavengerwa on behalf of SMM requesting SAS debtors not to pay to SAS. With respect to TAP Building Products Limited, a customer of SMM based in Zambia, minutes of an audit committee of the board attended by Manikai, confirm that Gwaradzimba was aware that TAP owed SAS but instructed the company not to pay.

The investigations have revealed that between 1 April and 6 September 2004, SMM received substantial amounts from SAS. Although Gwaradzimba admitted in the UK proceedings that SAS had been paying to SMM, he has refused to confirm the same during our investigations.

Bank documents confirming remittances by SAS to SMM were examined by the Investigation team. It was confirmed that SMM did receive the funds meaning that at the very least the alleged claim against SAS should have been reduced.

In support of the claim by SMM against SAS, a reconciliation sheet shows clearly that SMM was dealing directly with customers. An extract of the claim is shown below:

Reference has been made to a default judgment obtained against SAS in the South African court. A copy of these affidavit deposed to by Gwaradzimba was reviewed.

Gwaradzimba makes the case that this judgement confirms externalisation of funds. However, it is important to set out the facts.

An extract of the affidavit reads as follows:

It is clear from the above that the liquidators withdrew their defence to the action. We then asked why the liquidators would choose to withdraw from the action. Below is an extract of a letter dated 20 November 2006 from Gwaradzimbas attorneys regarding this matter?

The liquidators met with the Investigation team during their visit in Zimbabwe in mid-November 2010. The liquidators of SAS indicated that they had made a decision to expunge the SMM claim. They pointed out that under South African laws they are compelled to examine any proved claim and they had done in respect of SMMs claim. They tried to obtain clarification to no avail from Gwaradzimba.

During the visit, a meeting between Gwaradzimba and SAS and Petter liquidators was arranged. It emerged at the meeting that Gwaradzimba had not met with any of the liquidators in South Africa.

This is quite unusual that Gwaradzimba would choose not to cooperate with the South African liquidators given the nature of the allegations against Mawere.

Our findings have confirmed that the rescission order did not confirm any fraud.

What it did was to allow SMM to prove its claim against SAS.

We have found no evidence that any court has made a finding of fraud against Mawere in South Africa in respect of the cession court order as alleged.

Allegations of fraudulent payments to T & N

It has been alleged that in making payments to T & N, the laws of Zimbabwe were violated.

In a letter to Hon. Chinamasa dated 16 November 2010, Gwaradzimba stated as follows: Copy of the GOZ Guarantee for the Minerals Marketing Corporation of Zimbabwe (MMCZ) borrowings of US$60 million from KBC Bank of the United Kingdom (UK). MMCZs borrowings from KBC were made for purpose of assisting Shabanie Mashaba Mines (Pvt) Ltd, which assistance was made necessary by the Companys financial distress, which in turn had been brought about as a result of the externalisation of SMMs funds for part of the settlement of Africa Resources Limited (ARL) BVIs commitments to T&N Plc (T&N) in terms of the Purchase and Sale Agreement (the PSA), between ARL and T&N, in respect of the shareholdings in SMM -Holdings Limited (SMMH) and THZ Holdings Limited (THZH), two UK based companies, the subject of the PSA. At the time of the PSA, SMMH owned 100% shareholding of SMM in Zimbabwe.

The investigations have revealed that the correct position is that SMM did not receive any funds in US dollars.

Rather what the company received was the Zimbabwe dollar equivalent of US$60 million. Accordingly, the proceeds of the KBC loan could not be used to discharge any foreign payments.

More importantly, the funds were disbursed in 1998. What is important is to look at the audited financial statements of SMM for the year ended 31 December 1998.

The Balance Sheet of SMM as at 31 December 1998 clearly confirm that funds were injected into SMM as long term loans.

Under the capital employed, the long-term loans payable is shown as Z$1.98 billion compared to Z$161 million the previous year.

The increase in the long term loan reflected the conversion of SMMs short-term borrowings of Z$985.82 million shown as at 31 December 1997 into long-term debt.

Notes 9 and 17 are, therefore significant in helping explain the application of the Z$ proceeds of the KBC facility.

Note 9.2 reads as follows:

The loan, which is denominated in US dollars, is not forward-covered and bears interest at LIBOR plus 0.65% per annum. The loan is guaranteed by the GOZ through the RBZ. The loan is repayable in eight equal, consecutive semi-annual instalments starting March 2000.

Note 17 reads as follows:

The balances are made up of the short term revolving offshore finance, bankers acceptances and commercial paper.

It is important to look at Note 17 for the year ended 31 December 1997. The note refers to Bank Loans and Offshore Finance Facilities and 17.2 states as follows:

The balances (Z$985.82 million) are made up of short-term revolving offshore finance facilities, bankers acceptances and commercial paper. The offshore finance facilities are denominated in US dollars which have not been covered forward and bear interest at LIBOR plus rates ranging between 1.25% and 1.75%. Unlike in 1996, where offshore finance facilities repayment terms were extended to 1998, no extension of the repayment terms have been granted for the current year. The bankers acceptances and commercial paper are discounted at market rates prevailing at the time of issue.

With respect to the above mentioned short term borrowings whose duration could not be extended, the finance charges were Z$331.88 million and Z$910.96 million for the years ended 31 December 1997 and 1998, respectively.

Accordingly, for the year ended 31 December 1998, SMMs debt service related charges stood at: Z$1.9 billion which is roughly the same amount that SMM received from the KBC facility i.e. Z$1.98 billion.

So it is clear from the above that all the proceeds from the KBC facility were used to refinance the SMM short-term facilities.

In the premises, how then can Mr. Gwaradzimba who was the companys auditor now wish to misrepresent the facts that government guarantee was necessitated by the Companys financial distress. He should know better.

The reason for the refinancing was that the RBZ took a decision that the revolving facilities granted to exporters like SMM would be terminated meaning that SMM would have had no choice but to repay the local indigenous banks that were used as conduits for the Memorandum of Deposit Facilities (MDF).

With respect to paragraph 2, Gwaradzimba states as follows: Copy of GOZ Guarantee for Zimbabwe dollar equivalent of US$18 million for SMMs borrowings for its working capital requirements. Honourable Minister, please note that the design of this guarantee was fraudulent in that instead of clearly spelling out SMM as the beneficiary, the guarantee refers n the facility being made available to the Mining Sector.

The KBC loan was fully repaid in 2001.

However, at the time, it was explained to us that the GOZ of Zimbabwe had introduced concessionary finance facilities for exporters like SMM.

Notwithstanding, SMM could not access the facilities due to the conditions stipulated by KBC. While the loan was outstanding, SMM had no access to the needed working capital facilities.

Where is the fraud? The GOZ put in place instruments that allowed exporters to borrow from commercial banks at concessionary interest rates as compensation for the fixed exchange rate applicable in respect of converting the foreign exchange proceeds into the local currency.

With respect to the allegation that no funds were injected into SMM as promised: Copy of the 5MM Board of Directors Meeting minutes of 15 March 1996, proposing the passing of a special resolution allowing for the use of SMM funds to pay for ARLs commitments to T&N mm terms of the PSA. The said special resolution was secured fraudulently by Mr Mawere, in that Mr Mawere undertook to have injected into SMM, shortly to underpin operations, between US$25 million and US$30 million, in exchange for SMM making monthly payments of US$5 million to T&N on behalf o ARL, until the full purchase consideration of US$60 million, in terms of the PSA, was paid. Mr Mawere has never made this US$25-30 million injection into SMM. Instead, he used SMM funds to pay T&N, and to acquire other peripheral businesses, thus causing SMM financial problems that finally resulted in the Company being put under administration.

The balance sheet of SMM clearly shows that funds were injected after the acquisition.

The audited financial statements for the year ended 31 December 1996 shows an injection of Z$596.75 million.

It has been explained that the intention was that SMM after acquisition would be able to negotiate its own facilities without relying on any guarantees from the parent company. This is what took place in this matter.

It has also been highlighted that Gwaradzimba was the auditor of the company at the material time.

A number of statements and allegations were made by Gwaradzimba regarding the acquisition transaction that the team had to investigate. Such statements are set out below:

ARL purchased shares in SMMH and THZH, from T&N in 1996. The correct position is that ARL through Africa Construction Limited (ACL) acquired the entire shareholding in SMMH and THZ through a leveraged transaction.

ARL did not have the funding for the Transaction with T&N (the Transaction). The payment mechanism was agreed between the parties. The obligation of ARL is clearly spelt out in the Sale and Purchase Agreement. It was to procure the payment of the purchase consideration from SMMs export proceeds. According to the representations made by ARL, it was clear from the outset that the entire acquisition by ARL would be financed by the vendor i.e. T & N.

ARL, through Mr Mawere, sought and obtained acceptance from SMM, for the provision of financial assistance to the tune of US$60 million, to meet ARLs commitments to T&N in terms of the PSA. According to ARL, no assistance was sought from SMM. Rather, as part of an agreed transaction, SMMs sole shareholder SMMH agreed for SMM to make available US$60 million for the acquisition by ACL and not ARL of the shares in SMMH and THZH. This was done in compliance of the UK and Zimbabwean laws. The party that would feel aggrieved would be the legitimate shareholder of SMM and there is no suggestion that T & N had a case against ARL in respect to the manner in which the deal was to be financed.

Mr Mawere promised to have injected into SMM, US$25 million to US$30 million, in exchange for SMM availing the US$60 million for the payment to T&N on behalf of ARL. We have confirmed funds were injected into the company. During the first year, a total of Z$596 million (equivalent to US$60 million) was injected as shown in the audited financial statements.

In the end, Mr Mawere never injected US$25 million to US$30 million into SMM, yet US$43 million was paid to T&N by SMM, causing SMM to be financially broke. According to the evidence placed before us, it would appear that SMM did secure the funds that it was authorised to borrow by its shareholder from local banks. However, the need to convert short term revolving lines of credit into medium term facilities appears to have been necessitated by the decision by the RBZ not to extent the Memorandum of Deposit Facilities beyond 31 December 1998.

MMCZ had to borrow US$60 million from KBC using GOZs guarantee of 31 July 1998, on behalf of, and in order to assist, SMM. As well, GOZ guaranteed Zimbabwe dollar equivalent of US$18 million on 19 July 2001 again through MMCZ, to provide working capital assistance to SMM. We have established that MMCZ did not borrow from KBC. What happened is that MMCZ received the Z$ equivalent from the RBZ through First Bank Corporation (FBC). The second facility was only granted after the full repayment of the KBC facility. Once the KBC facility was fully repaid, SMM could enter into new agreements.

SMM did repay KBC in Zimbabwe dollars using the RBZ official exchange rate. Evidence furnished to us confirms that SMM did not receive any US$ from KBC rather it received Z$. Although SMM received Z$ it had an obligation to repay in US$ from its export proceeds. However, when the exchange rate became unfavourable SMM did repay the full amount outstanding in the currency it had received the funds. However, this was after it had repaid US$18 million in foreign currency. The total amount of foreign currency generated by SMM during the tenor of the KBC facility was US$136 million. The allegation that a crime was committed through SMM being able to access facilities that other exporters were able to access appears to be without any foundation. In fact it was the requirement by government that the facilities should be routed through MMCZ.

Legal Position with respect to Financial Assistance

It has been alleged that the SMM acquisition violated the Companies Act of Zimbabwe. The relevant section of the Act is Section 73 which provides as follows:

Section 73 reads as follows:73 Financial assistance by company for purchase of its own or its holding companys shares

(1) It shall not be lawful for a company to give, whether directly or indirectly, and whether by means of a loan, guarantee, the provision of security or otherwise, any financial assistance for the purpose of or in connection with a purchase or subscription made or to be made by any person of or for any shares in the company or, where the company is a subsidiary company, in its holding company unless

(a) such assistance is given in accordance with a special resolution of the company; and

(b) immediately after such assistance is given, on a fair valuation the

companys assets, excluding any asset resulting from the giving of the assistance, exceed its liabilities and it is able to pay its debts as they become due in ordinary course of its business.

Based on the above, the investigations have confirmed that finance assistance by a company for the purchase of its own shares or its holding companys shares is permissible. This point was raised by AMG in the UK litigation. The UK court ruled that there was nothing illegal about the manner in which the acquisition was structured and performed.

The letters below do provide content and context as to how Mawere’s journey towards the acquisition not of SMM, the Zimbabwean company, but its sole parent, SMM Holdings Private company (SMMH), a UK registered company, from.its sole shareholder, T & N International as reflected on first page of the Sale and Purchase Agreement concluded on 7 7 March 1997.

Warning: Undefined variable $user_ID in /home/iniafrica/public_html/wp-content/themes/zox-news/comments.php on line 49

You must be logged in to post a comment Login