Editorial

SMM Corporate Heist, The Reconstruction That Never Was

Published

3 years agoon

Brian Kazungu, 25/04/2021

The world is full of tragic stories of cruel dispossession where rightful owners of properties, big or small, expensive or cheap have been stripped of the right to enjoy what legally belongs to them, sometimes even through the manipulation of the law by those meant to be its custodians.

This is quite often the reality in communities where there are serious violations of the rule of law which includes but is not limited to judicial capture.

One story that stands out in the history of corporate heists is the divestment of shareholders of a company called SMM Zimbabwe in 2004 through an extrajudicial mechanism, where a Minister of Justice, through the circumvention of courts, paved way for the take-over of a mining giant.

SMM Zimbabwe is a company whose shares were wholly owned by SMM Holdings, a United Kingdom registered business which was purchased from T&N Holdings by Africa Resources Limited (ARL) but was later put under reconstruction on allegations of state indebtedness.

For almost two decades, SMM has controversially patrolled the ‘streets of merchants’ with a mirage of a company under reconstruction subject to the Reconstruction Act and yet in full display of the behaviour of a normal company that is subject to the Companies Act.

In putting this company under Reconstruction, then Minister of Justice in Zimbabwe, Patrick Chinamasa issued a Reconstruction Order and made Afaras Gwaradzimba to be the State Appointed Administrator as an alleged attempt to turn the fortunes of this asbestos mining giant.

While responding to questions in Parliament, Chinamasa claimed that SMM was being mismanaged and that its debt was going out of hand plus workers were not getting their salaries even for a period of up to three months.

Surprisingly, more than a decade later, the government appointed corporate ‘messiah’ has failed to perform any ‘business miracles’ in the ‘theatre of commerce’ and seems to have rather unleashed more industrial demons that continue to haunt workers and the people of Zvishavane.

In a disturbing twist of fate, a remedy which was allegedly meant to treat a mild financial illness ended up causing a long term corporate paralysis to a serious foreign currency earning company which employed thousands of people and which positively changed many lives in the country.

The workers which Chinamasa claimed to feel pity for are fed up with the drama in the company and have thus applied to the Minister of Mines to have Gwaradzimba given the red card for cruelty and incompetence as they are owed almost US$40 million and are being evicted from their homes.

Mr Justice Chinhema, Secretary General of the Zimbabwe Diamond and Allied Minerals Workers Union who is representing SMM workers said that Gwaradzimba has failed, neglected or refused to settle salary arrears in excess of over US$19 260 667.99 owed to current workers since January 2012 to November 2017. Salary arrears from December 2017 to date are yet to be computed. 991 ex-employees are owed US$17 676 537.50

Interestingly, unbeknown to these disgruntled workers, by virtue of having issued 76% of the SMM shares to Nickdale, an RBZ affiliated company, a development which confirms that a company is now reconstructed, Gwaradzimba technically ceases to have control over SMM.

More-so, while dealing with the above mentioned shares, Gwaradzimba, the SMM ‘guardian’, without the knowledge of the Registrar of Companies altered a traditional CR2 form to incorporate his signature, a development which has been widely described as an act of fraud.

As if that was not enough, he further on created a ‘fictitious’ company called SMM Holdings (UK) after a failed take-over of the actual SMM Holdings in the United Kingdom which was dismissed with costs by the UK Supreme Court of Appeal under case number A3/2008/0918.

To make matters worse, during President Mugabe’s reign, the Ministerial oversight of SMM was transferred from the Ministry of Justice where Gwaradzimba had sole control of SMM to the Ministry of Mines where a Board was appointed under ZMDC thus rendering Gwaradzimba ‘useless’.

As such, despite many circumstances that are on record which point to the illegality of Gwaradzimba’s continued stay at the helm of the troubled mining entity, he is still found at its helm even with his weight of ‘irresponsibility’ seeming to make the company sink further into the dungeons of business oblivion.

The SMM reconstruction justification put forward by Chinamasa then coupled with the controversial appointment of contested characters as company custodians in violation of corporate governance principles, has left many stakeholders including the State itself with an egg in the face as results on the ground shows no evidence of any meaningful rescue attempt.

In parliament, the SMM issue was hotly debated especially bordering on the legality and effectiveness of processes and provisions that were being implemented with some being said to be unconstitutional political interference by Members of Parliament such Job Sikhala.

The constitutionality of processes and provisions of the Reconstruction remedy were hotly debated by Members of Parliament but to no avail since the real reasons behind the whole SMM debacle seemed to beyond both business and the law since legal recommendations even by the highest financial institution in the country, the RBZ were thrown under the bus.

In a 20th July 2005 Parliamentary Debate under the motion ‘Economic Challenges Facing Zimbabwe’, Member of Parliament, Job Sikhala asked the Minister of State Enterprises, Anti-Monopolies and Anti-Corruption to shed light on the indebtedness of SMM.

Gwaradzimba, a former auditor of SMM’s appointment to become its State chosen Administrator raised eyebrows in the corridors of corporate morality but was still trampled down just like the acceptance of its former legal person Mr Manikai of Dube, Manikai and Hwacha to become lawyer of SMM under the so called ‘Reconstruction’ mechanism.

On the issue of externalisation and State indebtedness, Government appointed investigators and the Reserve Bank of Zimbabwe found no evidence of state indebtedness and no proof of wrong doing in SMM despite the fact that Chinamasa said the following:

“I have already alluded to my earlier responses, as at the 6th September 2004, when I issued the Reconstruction Order, SMM Holdings was indebted to the State in the sum of Z$115 billion between that date and April 2005.”

RBZ Governor, Gideon Gono, in his submissions to the late President Robert Mugabe, refuted SMM’ State indebtedness saying “Based on information available, the Bank has also tested the veracity of the declaration of SMM as “an Insolvent State-Indebted Company” upon which the Reconstruction Law was created and applied….

…Your Excellency, at law the above SMM liabilities at the time the Reconstruction Order was instituted did not qualify as state loans to SMM.”

Gono quashed and castigated the Reconstruction approach in the SMM issue and pleaded with former President Mugabe to reconsider it because of its negative consequences on the image of the country and on attracting investment.

More-so, an executive summary of the final report on the findings of an investigation into the affairs of SMM which was done by the Investigator, Assistant Commissioner, Mr. S. Mangoma etal cleared SMM of wrong doing by stating the following:

“We have established that there is no connection between the acquisition of SMM and the guarantees granted to SMM. The guarantees were used to convert expensive short-term facilities into a medium term loan.

The facility was structured and negotiated by SMM’s financial advisors, First Merchant Bank (FMB).

The acquisition of SMM was not guaranteed by the government rather it was a leveraged buy-out in which the assets of SMM were used to acquire the shares in its holding company under an arrangement approved by the RBZ.”

In all this, with a deliberate keen interest in the SMM reconstruction drama and an analysis of the paper trail thereof, one can easily that the whole process was a fallacy.

It was just an interesting story told to the gullible masses while their attention was being diverted from the heist that was happening just like was also confirmed Professor Jonathan Moyo, a former Minister in the Zimbabwe government.

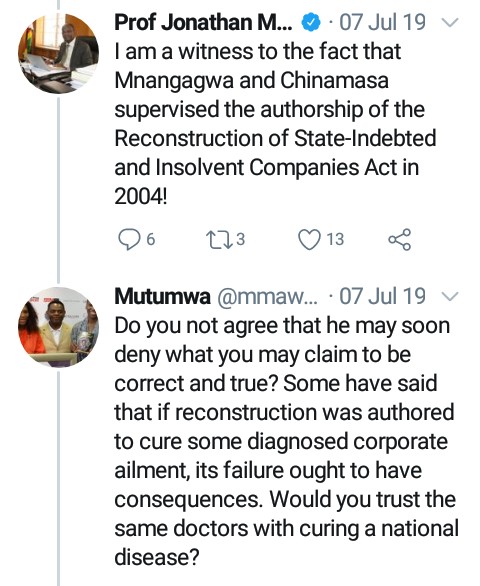

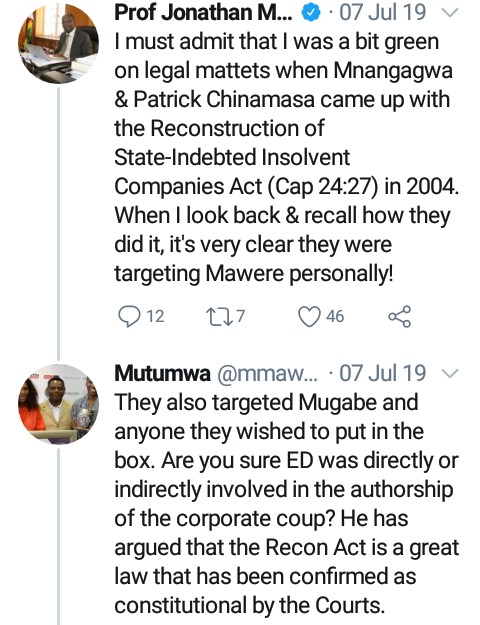

In a twitter conversation with Mutumwa Mawere, Professor Moyo said “I must admit that I was a bit green on legal matters when Mnangagwa & Patrick Chinamasa came up with the Reconstruction of State-Indebted Insolvent Companies Act (Cap24:27) in 2004. When I look back &recall how they did it, its very clear they were targeting Mawere personally!

I am a witness to the fact that Mnangagwa and Chinamasa supervised the uthorship of the Reconstruction of State-Indebted and Insolvent Comoanies in 2004!”

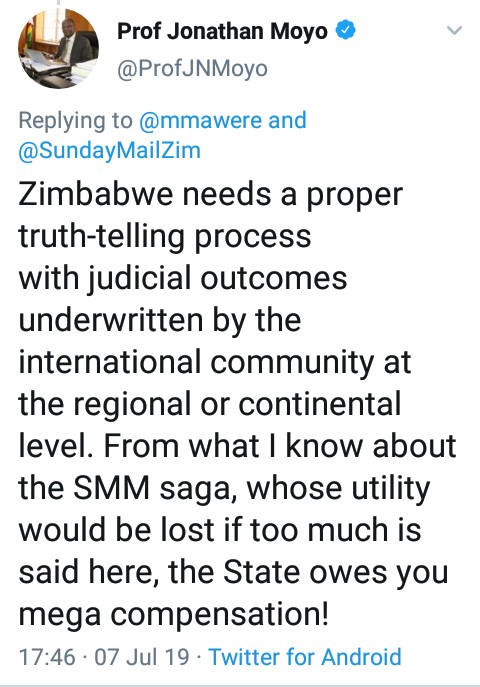

He further went on to say that “Zimbabwe needs a proper truth-telling process with judicial outcomes underwritten by the international community at the regional or continental level. From what I know about the SMM saga, whose utility would be lost if too much is said here, the State owes you mega compensation.” Professor Moyo tweeted to Mawere

Brian Kazungu is an Author, Poet, Journalist, and Technology Enthusiast whose writing covers issues to do with Business, Travelling, Motivation and Inspiration, Religion, Politics, and Communication among others. https://www.amazon.com/author/briankazungu https://muckrack.com/brian-kazungu http://www.modernghana.com/author/BrianKazungu [email protected] @BKazungu-Twitter He has written and published several books covering various aspects of human life including leadership, entrepreneurship, politics, personal development as well as poetry and travel. These books are found on Amazon https://www.amazon.com/author/briankazungu

Warning: Undefined variable $user_ID in /home/iniafrica/public_html/wp-content/themes/zox-news/comments.php on line 49

You must be logged in to post a comment Login